SpaceTech Weekly Recap – October 27 - November 02, 2025

Major funding, new missions, and setbacks: what mattered last week in space innovation.

Each week we bring you a curated look at the biggest moves in SpaceTech – from funding and M&A to market trends, contracts, and a quick stock snapshot.

“Money in space tech is clearly moving toward scale, defense, and real commercial infrastructure. EnduroSat’s $104M raise shows investors are betting on mass production. Voyager’s acquisition of ExoTerra fits the wave of consolidation around propulsion and defense tech — smart move as those capabilities become critical. ESA’s €1B military satellite plan and new Tokyo office show Europe getting serious about both security and global presence. And AST SpaceMobile’s 10-year deal with stc proves direct-to-device is turning into a real market, not just hype. Feels like space is shifting from “innovation talk” to “execution mode” — building systems that actually work and scale.” - Commentary by Matej Pretković

We provide consulting, fundraising support, market research, and advisory to help you grow and succeed. Contact us at mpretkovic@cyclopcorp.com.

Here is a quick overview of news:

M&A & Funding

EnduroSat Raises $104M to Mass-Produce ESPA-Class Satellites

Voyager Acquires ExoTerra to Boost U.S. Propulsion Capabilities

Market

European Space Agency Ventures into Defence with €1B Military Satellite Program

ESA Opens Tokyo Office to Strengthen Strategic Ties with Japan

Launch

Iridium Launches Global GPS “Protection-on-a-Chip” Device

Slingshot Aerospace Supports UK Satellite Tracking Amid Orbital Congestion

Contracts

AST SpaceMobile and stc Group Ink 10-Year Deal for Space-Based Cellular Broadband

Redwire Partners with EDGE to Expand Space Infrastructure Solutions

Read our latest weeklies for more recent SpaceTech updates

Stay up to date with funding, deals, trends, contracts, and market insights in one weekly update.

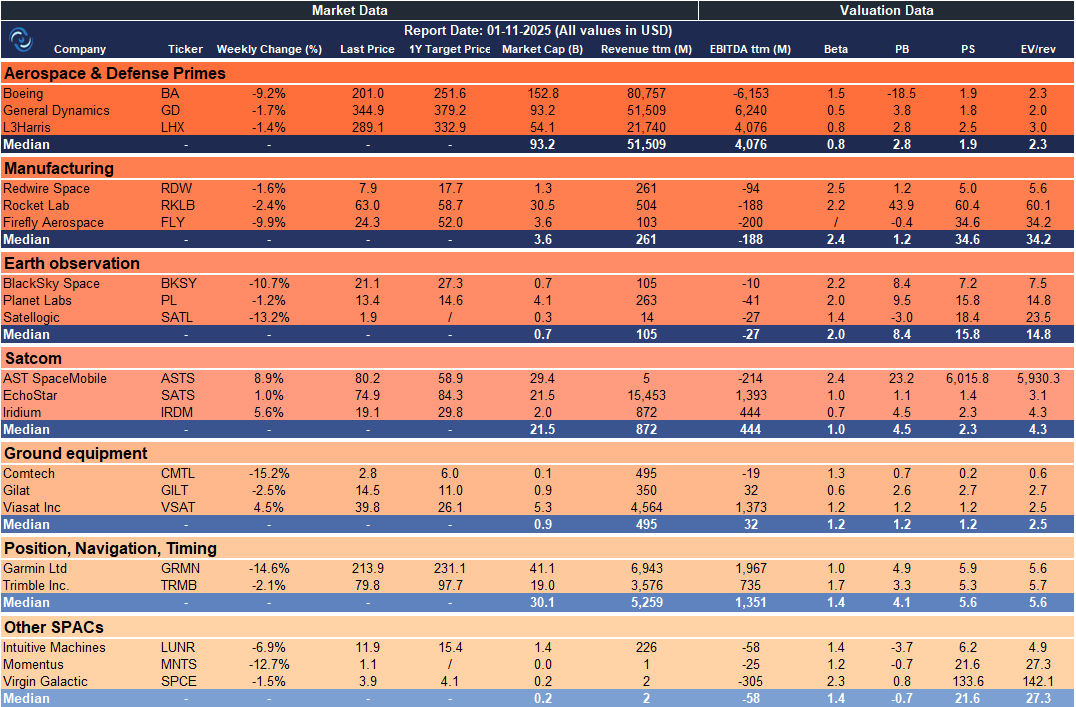

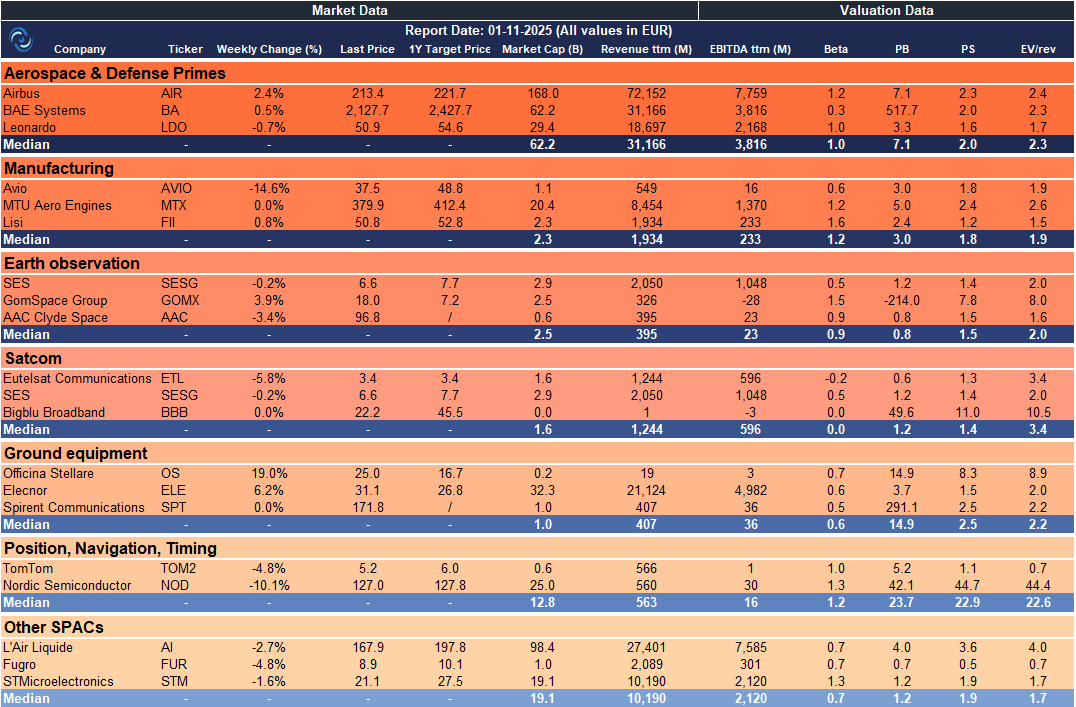

Weekly SpaceCap - These tables track weekly stock performance and key metrics for global and European SpaceTech companies, giving a quick snapshot of market trends.

US – SpaceTech Stocks Snapshot

Europe – SpaceTech Stocks Snapshot

Need a full breakdown by sector or a customized template with your own metrics? Get in touch with us at mpretkovic@cyclopcorp.com.

Read the news in more detail:

M&A & Funding

EnduroSat Raises $104M to Mass-Produce ESPA-Class Satellites

What happened: EnduroSat raised $104 million in a funding round to scale satellite production, aiming to manufacture two ESPA-class satellites per day. Investors include Riot Ventures, Google Ventures, Lux Capital, the European Innovation Council Fund, and Shrug Capital. The funding coincides with the opening of EnduroSat’s new Space Center in Sofia, a 188,340-square-foot facility equipped with RF labs, hardware and mechanical labs, ISO-class clean rooms, and space qualification facilities.

Why it matters: This funding supports mass production for growing constellation operators and addresses accelerating demand for small- to mid-sized satellites. By expanding capacity and speed, EnduroSat aims to shorten time-to-orbit and deliver cost-efficient satellite constellations at scale, aligning with a broader industry trend toward modular, scalable space infrastructure and faster data access. The Sofia Space Center underscores a shift toward vertically integrated manufacturing in the sector.

Investor angle: The round signals strong market traction and confidence from notable backers—Riot Ventures, Google Ventures, Lux Capital, the European Innovation Council Fund, and Shrug Capital—in EnduroSat’s ability to scale production and broaden access to space data. The deal highlights strategic value in vertically integrated, high-volume small-satellite manufacturing, though execution and competitive risk remain as the company pursues rapid ESPA-class output.

Voyager Acquires ExoTerra to Boost U.S. Propulsion Capabilities

What happened: Voyager Technologies [NYSE: VOYG] acquired ExoTerra Resource, a developer of advanced electric propulsion systems, closing a critical propulsion capability gap for U.S. defense and commercial spacecraft. ExoTerra’s Halo thrusters, proven on DARPA Blackjack ACES spacecraft and supplied to York Space Systems, provide precise maneuvering, long lifetimes, and high-efficiency delta-V. The acquisition allows Voyager to scale production of flight-proven propulsion systems, enhancing national space resilience and supporting strategic initiatives like Golden Dome.

Why it matters: Reliable and domestically produced propulsion systems are essential for spacecraft to maneuver, avoid threats, and sustain mission advantage, particularly in defense applications. By integrating ExoTerra’s technology, Voyager can accelerate delivery of critical spacecraft capabilities, improve cost efficiency, and strengthen U.S. space industrial independence. The deal also underscores a broader industry trend toward consolidating specialized space technologies to rapidly scale critical infrastructure.

Investor angle: The acquisition signals Voyager’s commitment to building vertically integrated, mission-critical capabilities, reducing reliance on external suppliers. Investors may view the move as enhancing Voyager’s competitive moat in propulsion and defense-related space markets. With ExoTerra’s proven technology and contracts with NASA, commercial operators, and the Space Development Agency, the company is well-positioned for growth in both commercial and national security segments, though execution and integration risks remain.

Market

European Space Agency Ventures into Defence with €1B Military Satellite Program

What happened: In November, the European Space Agency (ESA) will ask its 23 member states to contribute roughly €1 billion to develop a military-grade reconnaissance satellite constellation. The plan is part of a three-year, €22 billion ESA budget and aims to deliver ultra-high-resolution optical imagery to Earth at intervals under 30 minutes for security, defense, and disaster-management use. The EU calls the system Earth Observation governmental service (EOGS); ESA terms it European Resilience from Space, signaling defense projects within ESA’s remit.

Why it matters: The move formalizes defense-oriented space activity within a European public program and complements civilian missions like Galileo and Copernicus. It reflects policy acceptance of defense projects by ESA member capitals and aligns with broader EU space spending considerations for 2028–2034, with a pledging summit in Bremen to finalize funding commitments.

Investor angle: The plan suggests a potential new revenue channel for European defense-oriented space infrastructure and could affect valuations of space-tech players aligned with ESA and EU defense initiatives. The outlook hinges on securing roughly €1 billion from member states and on the 2028–2034 EU space-budget framework, with execution risks including funding approvals and schedule timelines.

ESA Opens Tokyo Office to Strengthen Strategic Ties with Japan

What happened: On 28 October 2025, the European Space Agency (ESA) announced it will establish its first presence in Asia by opening a Tokyo office. A staff member will work in Tokyo’s X-NIHONBASHIi innovation hub, and ESA representation will be based in the X-IHONBASHI TOWER, a facility operated jointly by Mitsui Fudosan Co., Ltd. and Cross U. The move strengthens ESA’s partnership with Japan and deepens cooperation with JAXA and Japan’s space ecosystem, building on a 2024 ESA delegation and the Joint Statement on Next Big Cooperations.

Why it matters: The establishment signals a formal expansion of ESA’s presence in Asia to elevate cooperation with Japan across Earth observation, planetary defence, low Earth orbit and exploration, and space science, and to strengthen ties with JAXA and Japan’s space industry. It follows decades of collaboration and the Joint Statement on Next Big Cooperations, and creates an on‑the‑ground platform to coordinate joint missions and initiatives from Tokyo.

Investor angle: The move signals deeper Europe–Japan space cooperation and the potential for more joint programs and commercial collaboration that could broaden opportunities for European and Japanese space firms. The Tokyo outpost may improve on‑site programmatic coordination and inter‑agency collaboration, potentially accelerating timelines for future missions and enhancing the strategic value of European–Japanese space partnerships.

Launch

Iridium Launches Global GPS “Protection-on-a-Chip” Device

What happened: Iridium announced the launch of a global GPS device marketed as ‘Protection-on-a-Chip,’ described as revolutionary, with the announcement dated Oct 27, 2025. The device integrates protective capabilities on the GPS chip, representing a novel addition to Iridium’s product lineup. The report emphasizes the global reach of the device and positions Iridium as advancing an integrated safety feature within its GPS products.

Why it matters: This development highlights ongoing innovation in GPS protection technology and expands Iridium’s portfolio in global positioning devices. By integrating protection on the GPS chip, the approach could enhance robustness of connected devices in remote or challenging environments, aligning with demand for secure, reliable global navigation solutions. Its significance rests on combining hardware-level security with global satellite coverage.

Investor angle: Iridium’s move suggests a potential expansion of its GPS-related offerings, which could create new revenue opportunities if demand for chip-level protection grows. The lack of details on pricing, partners, or rollout means assessment of financial impact remains speculative. Investors will want to monitor any follow-up disclosures on adoption by industries such as outdoor, maritime, or aviation that rely on global satellite connectivity.

Slingshot Aerospace Supports UK Satellite Tracking Amid Orbital Congestion

What happened: Slingshot Aerospace announced it is supporting the UK Space Agency’s satellite tracking amid rising orbital congestion. The company highlights its Slingshot Global Sensor Network—described as the world’s only day/night LEO-to-xGEO optical sensor network with 150+ sensors across 20+ locations—providing persistent space object tracking. It also lists capabilities in space traffic coordination, space domain awareness, conjunction assessment data, orbit determination, and ephemeris generation to enhance mission safety and collaboration.

Why it matters: Orbital congestion increases the need for real-time space traffic coordination and domain awareness. Slingshot’s platform combines its global sensor network with data products such as conjunction data, pattern-of-life insights, neighborhood watch insights, and AI-driven monitoring to support safe operations across missions from LEO to GEO and beyond, illustrating growing demand for advanced tracking tools in both civil and commercial space activity, including international collaborations.

Investor angle: The UK Space Agency collaboration serves as validation of Slingshot’s market-ready capabilities in space traffic coordination and domain awareness, potentially expanding its addressable market. With end-to-end data offerings—from sensor networks to orbit determination and AI-driven insights—Slingshot appears well-positioned to capitalize on demand for space-safety, security, and operations tools across civil, commercial, and defense segments.

Contracts

AST SpaceMobile and stc Group Ink 10-Year Deal for Space-Based Cellular Broadband

What happened: AST SpaceMobile (NASDAQ: ASTS), building the first global space-based cellular broadband network, signed a 10-year commercial agreement with stc group to provide direct-to-device satellite connectivity across Saudi Arabia and select Middle East and Africa markets. As part of the deal, stc committed $175 million in prepayments and long-term revenue. AST SpaceMobile will build three ground gateways and a Network Operations Center (NOC) in Riyadh to integrate satellite and terrestrial networks, enabling 4G/5G service directly to standard smartphones without specialized devices or software.

Why it matters: This agreement expands mobile coverage to underserved and remote regions, bridging digital divides and supporting economic development, education, and connectivity. By leveraging satellite broadband alongside terrestrial networks, stc and AST SpaceMobile aim to deliver seamless, high-speed mobile services across the MENA region, a first for the area. Commercial services are expected to launch in Q4 2026, pending regulatory approvals.

Investor angle: The partnership highlights AST SpaceMobile’s growing commercial traction and long-term revenue visibility in a strategic regional market. stc’s prepayment and infrastructure commitments reduce adoption risk and demonstrate confidence in AST’s technology. The deal positions both companies to capture value in satellite-based mobile broadband, a sector with high growth potential, though regulatory and operational execution risks remain.

Redwire Partners with EDGE to Expand Space Infrastructure Solutions

What happened: Redwire Corporation, through its wholly owned subsidiary Edge Autonomy, signed a Memorandum of Understanding with UXV Technologies to deepen cooperation in uncrewed aerial systems. The agreement aims to integrate UXV’s Soldier Robotic Controller ground control stations with Edge Autonomy’s Stalker UAS to enhance long-range autonomous capabilities. The MoU was signed in Riga, Latvia, during the Danish-Latvian Industry Days, with Nordic and Baltic government and industry representatives in attendance.

Why it matters: The collaboration strengthens interoperability among European defense technology providers at a time when EU and NATO priorities emphasize cross-border innovation and defense industrial base expansion. By combining UXV’s modular ground control solutions with Edge Autonomy’s long-range UAS, the partnership aims to accelerate delivery of modular, mission-ready, and cost-efficient UAS capabilities for allied forces.

Investor angle: The MoU signals strategic value by potentially expanding Redwire/Edge Autonomy’s addressable markets in European and allied defense segments and by enhancing interoperability with NATO/EU partners. However, as the arrangement is a memorandum of understanding, actual revenue and contracts will depend on subsequent binding agreements and defense procurement timelines.

We’d love your feedback on SpaceTech Weekly - help us improve and get 15% off our services!

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. While we strive to ensure the accuracy and timeliness of the information presented, we cannot guarantee its completeness or correctness. Readers should conduct their own research and consult a qualified financial professional before making any investment decisions. Past performance is not indicative of future results.

The stc deal really validates the whole direct to device model in a way that pilot programs never could. Having a major regional carrier commit $175M upfront and build three ground gateways shows they're treating this like core infrastrucure not a science experiment. Q4 2026 launch timing lines up well with the broader constellation rollout, and if Saudi deployment goes smooth it sets a template for other markets with similar geography.