SpaceTech Weekly Recap – November 24 - November 30, 2025

Major funding, new missions, and setbacks: what mattered last week in space innovation.

Each week we bring you a curated look at the biggest moves in SpaceTech – from funding and M&A to market trends, contracts, and a quick stock snapshot.

“Space tech keeps accelerating in Europe as Infinite Orbits raises €40M to lead in-orbit servicing, backed by a solid €150M order book. Meanwhile, the EIB launches its Space TechEU programme, unlocking €1.4B to help SMEs and mid-caps scale across the space value chain. Big moves from ESA with record €22B funding boost underline Europe’s push for space sovereignty and innovation. Across the pond, BlackSky advances with rapid, high-res satellite imaging.” - Commentary by Matej Pretković

We provide consulting, fundraising support, market research, and advisory to help you grow and succeed. Contact us at mpretkovic@cyclopcorp.com.

Here is a quick overview of news:

M&A & Funding

Infinite Orbits Secures €40M to Become Europe’s In-Orbit Servicing Leader

Market

EIB Launches Space TechEU Programme to Boost Europe’s Space Sector

BlackSky Achieves Breakthrough Speed with Gen-3 Image Transmission

ESA Member Countries Pledge Record Funding at Ministerial Meeting

UK Increases ESA Funding Emphasizing Growth and Security Priorities

Launch

NASA’s Innovative Cost-Reduction Tech Demo Set for Upcoming Launch

Contracts

Interlune Awarded U.S. Air Force Contract to Boost Helium-3 Supply for Quantum Research

Airbus and OneSat Chosen to Develop Oman’s Inaugural Satellite

Irish Firms Land Unprecedented €24 Million in ESA Contracts on 50th Anniversary

Read our latest weeklies for more recent SpaceTech updates

Stay up to date with funding, deals, trends, contracts, and market insights in one weekly update.

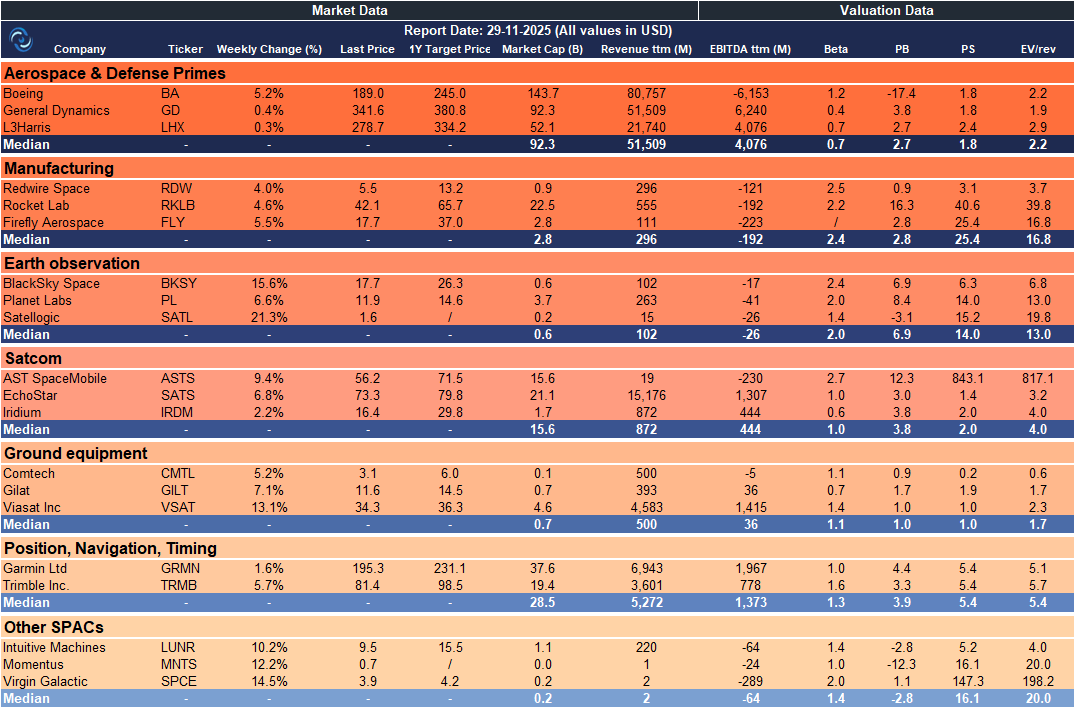

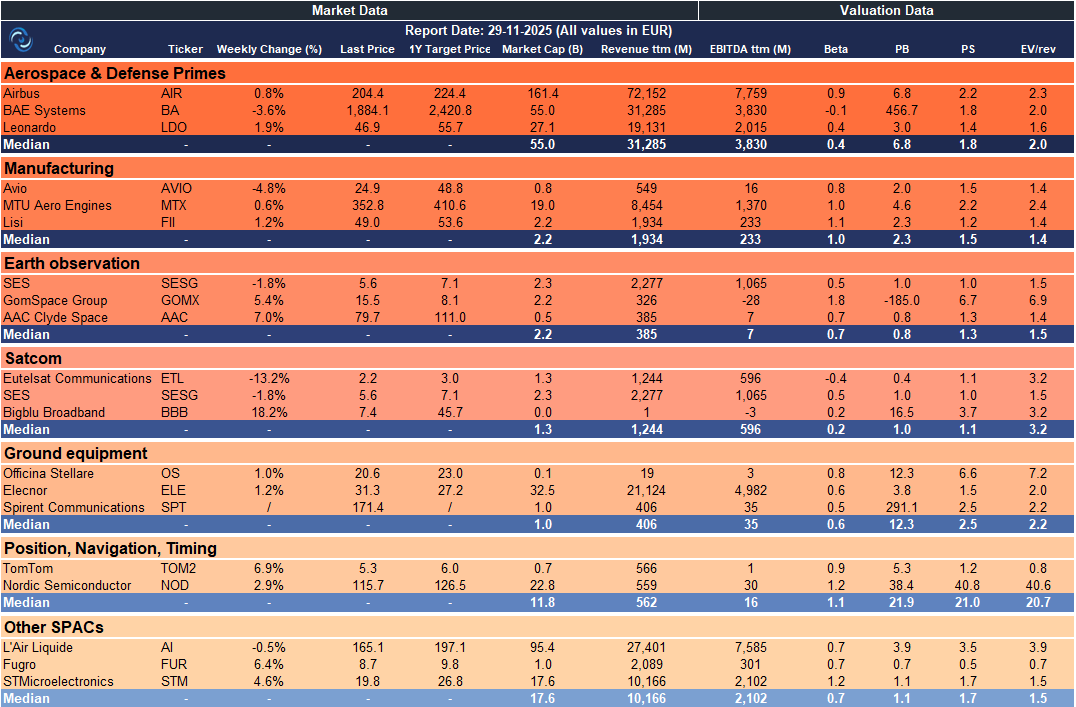

Weekly SpaceCap - These tables track weekly stock performance and key metrics for global and European SpaceTech companies, giving a quick snapshot of market trends.

US – SpaceTech Stocks Snapshot

Europe – SpaceTech Stocks Snapshot

Need a full breakdown by sector or a customized template with your own metrics? Get in touch with us at mpretkovic@cyclopcorp.com.

Read the news in more detail:

M&A & Funding

Infinite Orbits Secures €40M to Become Europe’s In-Orbit Servicing Leader

What happened: Infinite Orbits, a pioneer in in-orbit satellite servicing, announced closing an oversubscribed €40 million financing round. Backed by a €150 million order book, the funds will fuel its pan-European expansion with new offices planned in Luxembourg, Spain, UK, Germany, and Poland. The round includes major European private investors such as the European Innovation Council Fund, Matterwave Ventures, Wind Capital, Balnord, IRDI, and Newfund Capital.

Why it matters: This capital injection supports Infinite Orbits’ mission to strengthen Europe’s space sovereignty by providing critical services like satellite inspection and life-extension in GEO orbit. The company aims to accelerate deployment of its satellite servicing fleet, enhancing the security and sustainability of orbital operations while building trusted partnerships with European sovereign institutions.

Investor angle: The €40 million round, combining equity and venture debt, signals strong investor confidence in Infinite Orbits’ proven technology and commercial traction. With a secured €150 million backlog over three years, Infinite Orbits is positioned to capture growing demand for in-orbit servicing and open new space use cases beyond 2030. Risks remain around execution of rapid geographic and operational expansion, and competitive pressures in the emerging European space servicing market.

Market

EIB Launches Space TechEU Programme to Boost Europe’s Space Sector

What happened: The European Investment Bank (EIB) announced the launch of Space TechEU, its first dedicated financing programme targeting European space companies. This new initiative, part of the broader TechEU innovation programme, is set to mobilise an estimated €1.4 billion in investment, including €500 million of direct EIB financing. The programme focuses on supporting SMEs and mid-caps across the entire space value chain by providing credit lines and guarantees through partnerships with commercial banks. The European Space Agency (ESA) will provide sector-specific advice and technical expertise to banks participating in the scheme.

Why it matters: Space TechEU addresses persistent financing challenges faced by smaller and mid-sized space companies, enabling them to access bank financing and scale their innovations. By combining EIB’s financing power with ESA’s expertise and commercial banks’ outreach, the programme aims to strengthen Europe’s space autonomy and competitiveness, fostering innovation in satellite manufacturing, launch services, ground infrastructure, and space-enabled applications across industries such as telecommunications, agriculture, and climate management.

Investor angle: The initiative creates new financing opportunities for European space businesses at all stages of growth, particularly those underserved by traditional financing. By unlocking capital and reducing risk, Space TechEU supports a dynamic and innovative space ecosystem poised for long-term expansion. Risks include the challenge of educating financial institutions on space sector specifics and ensuring effective collaboration among EIB, ESA, and banks to achieve expected investment mobilisation.

BlackSky Achieves Breakthrough Speed with Gen-3 Image Transmission

What happened: BlackSky announced that its Gen-3 imaging satellite deployed within 24 hours of launch on Rocket Lab’s Electron mission ‘Follow My Speed,’ captured very high-resolution imagery at 35 cm, and quickly transmitted the data back to customers. This marks a significant improvement over Gen-2’s 1-meter resolution. The company plans to have about a dozen Gen-3 satellites in orbit by the end of 2026. Following the launch, BlackSky’s stock (BKSY) traded at $17.13, up 6.7% from market open.

Why it matters: The combination of faster image delivery and higher resolution strengthens BlackSky’s value proposition for DoD and commercial customers, providing secure, flexible ISR capabilities at speed and scale. The development positions the company to complement national assets and to grow its addressable market in real-time, mission-relevant imagery.

Investor angle: The Gen-3 breakthrough and the planned constellation expansion to 12 satellites by 2026 suggest potential revenue growth from government and commercial clients and an enhanced competitive position in the geospatial data market. Risks include execution of the multi-satellite rollout, reliance on continued demand for rapid imagery, and competition in the space-imaging sector.

ESA Member Countries Pledge Record Funding at Ministerial Meeting

What happened: At ESA’s Ministerial Council (CM25) in Bremen, member states approved €22.1 billion—the largest funding in the agency’s history. The 32% increase over the 2022 Ministerial (17% in real terms) was endorsed by 23 Member States, Associate Members and Cooperating States. They backed major science, exploration and technology programmes and a significantly larger budget for space applications (Earth observation, navigation, telecommunications), as well as the European Resilience from Space initiative. Subscriptions remain open through next year.

Why it matters: This funding advances ESA’s Strategy 2040, enabling missions described in Cosmic Vision (including LISA and NewAthena) and technology development for Voyage 2050, notably the L4 mission to Enceladus. It also strengthens Europe’s security and resilience through the European Resilience from Space, providing high-temporal/spatial imagery, new low-Earth orbit navigation services and secure connectivity, with a governance framework that keeps subscriptions open to accommodate the programme.

Investor angle: The decision signals a longer, higher-profile ESA pipeline and potential long-term contracts with European space suppliers across Earth observation, navigation and telecoms, as well as opportunities in advanced space technologies and dual-use applications. The plan’s 3.5% annual growth in science funding and an enlarged technology budget could accelerate development timelines and support healthier demand for space-related components and services, while the open-subscription approach introduces some execution risk as commitments are finalized.

UK Increases ESA Funding Emphasizing Growth and Security Priorities

What happened: The UK secured a £1.7 billion investment package in European Space Agency (ESA) programmes, agreed at the ESA Council of Ministers (CM25) in Bremen. This raises the UK’s total ESA funding to £2.8 billion over the 2025/26–2034/35 period, with further commitments planned for 2028. The funding will flow back to UK industry and universities as contracts to develop new technologies, sustaining thousands of high‑skilled jobs and advancing science and innovation. Notably, a record £162 million is allocated to launch programmes, including the European Launcher Challenge, to improve access to space, broaden the European market for commercial operators, increase resilience, and reduce launch costs for services like communications, navigation and weather forecasting. The package aims to secure assured space access for the UK and bolster national security; evaluation shows every £1 invested in ESA returns £7.49 in direct UK economic benefits.

Why it matters: The move underscores the UK’s strategy to grow its economy and strengthen security through space, backing thousands of high‑skilled jobs and driving science and innovation with tangible benefits to people and businesses, such as improved connectivity and more resilient infrastructure and public services. It also reinforces UK collaboration with European and global partners and positions British scientists, engineers and entrepreneurs at the forefront of international space programmes.

Investor angle: The package signals strong, long‑term government backing for UK space suppliers and universities through ESA contracts, potentially expanding the addressable market for UK tech and engineering firms. The record launch‑programmes funding and the anticipated 2028 commitments could support lower launch costs and greater private‑sector participation in space services, contributing to favorable revenue opportunities and portfolio resilience.

Launch

NASA’s Innovative Cost-Reduction Tech Demo Set for Upcoming Launch

What happened: NASA announced that its Cost-Saving Technology Demonstration is ready for launch, highlighting a demonstration of innovations designed to reduce costs for future missions. The announcement sits within NASA’s News & Events and signals continued efforts to validate affordable approaches to spaceflight, though the provided excerpt does not include technical details about the demo.

Why it matters: The move underscores NASA’s ongoing focus on cost efficiency and technology innovation in space exploration. By validating cost-reduction approaches across missions and programs, NASA aims to lower future expenses, accelerate development timelines, and potentially influence industry practices and supplier strategies toward more affordable spaceflight solutions. This aligns with broader industry trends toward open innovation and efficiency gains.

Investor angle: For investors, the demonstration highlights opportunities for contractors and tech developers involved in cost-saving innovations. Success could expand procurement opportunities and affect the valuation of participating companies if NASA adopts or scales the technology, while outcomes will depend on performance, funding, and project approvals. A positive outcome could signal a broader push for cost-effective solutions in government contracting and aerospace industry funding.

Contracts

Interlune Awarded U.S. Air Force Contract to Boost Helium-3 Supply for Quantum Research

What happened: Interlune was selected by AFWERX for a $1.25 million SBIR Direct-to-Phase II contract to develop technology separating helium-3 from domestic helium and double the U.S. supply. The project will prototype at pilot scale and define interfaces for integration with an existing U.S. helium liquefaction plant, with Phase III to be demonstrated at operational scale. The U.S. currently produces about 1 kilogram of helium-3 per year, and Interlune has a separate agreement to purchase more than $300 million of helium-3 from Bluefors, priced around $20 million per kilogram.

Why it matters: Helium-3 is essential for cooling superconducting quantum computers to near absolute zero, a key enabler for quantum R&D, and demand is rising as quantum computing moves toward commercialization. The program could expand domestic supply, reducing reliance on external sources, and the work will integrate with a U.S. liquefaction plant, while informing future lunar harvesting technology to meet industrial-scale needs.

Investor angle: The contract funds a potentially scalable domestic helium-3 separation solution, addressing a strategic bottleneck as demand for helium-3 grows with quantum computing commercialization. Success could enhance Interlune’s contract cadence and payoffs in government and industrial markets, helping stabilize helium-3 supply. Risks include execution at scale, price volatility, and competition for helium-3 supply.

Airbus and OneSat Chosen to Develop Oman’s Inaugural Satellite

What happened:The Sultanate of Oman’s national satellite operator, Space Communications Technologies (SCT), has awarded Airbus a full end-to-end contract to build OmanSat-1, the country’s first national telecommunications satellite. The spacecraft will be based on Airbus’s fully digital, software-defined OneSat platform and will provide flexible Ka-band coverage across Oman, its maritime economic zone, and wider regions spanning the Middle East, East Africa, and Asia. Airbus’s contract covers satellite design, manufacturing, ground-segment software, and launch — marking the 10th satellite ordered on the OneSat product line.

Why it matters: This marks a major milestone in Oman’s long-term strategy to build sovereign space and communications capabilities. By choosing a reconfigurable digital satellite, Oman gains the ability to dynamically shift coverage, capacity, and frequencies “on demand,” supporting government missions, maritime operations, oil & gas connectivity, banking networks, and rural broadband. The selection also reinforces the industry trend toward software-defined GEO satellites, which offer lower lifecycle cost, higher flexibility, and faster market responsiveness compared to traditional fixed-beam designs.

Investor angle: For Airbus, the deal strengthens its space backlog and demonstrates growing global confidence in the OneSat platform, supporting predictable multi-year revenue across design, manufacturing, and launch phases. The order confirms Airbus as a competitive leader in next-gen GEO systems at a time when operators increasingly prioritise software-defined flexibility over legacy satellites. For regional investors, OmanSat-1 could catalyse new connectivity markets in government, maritime, enterprise and rural broadband, but the commercial upside will depend on execution—particularly ground-segment readiness, launch timelines, and how effectively SCT can monetise capacity across Oman’s domestic and regional customer base.

Irish Firms Land Unprecedented €24 Million in ESA Contracts on 50th Anniversary

What happened: In 2024, Irish companies secured a record €24 million in European Space Agency (ESA) contracts, up from €9.9 million in 2023. A total of 116 Irish firms have contracted with ESA since Ireland joined the National Space Strategy in 2019. Notable projects included Ubotica’s CogniSAT-6 AI-powered satellite, Réaltra’s flight systems on ESA’s Ariane 6 launcher, and ÉireComposites’ advanced materials for satellite communications. The announcement coincides with the ESA Council of Ministers CM25 in Bremen, led by Minister Alan Dillon, as Ireland marks 50 years in ESA membership (since 1975).

Why it matters: The results underscore growing momentum in Ireland’s space sector and alignment with the National Space Strategy to position the country as an innovative contributor to Europe’s space ecosystem. The broader market is expanding, with the 2024 space market valued at €436.69 billion and projected to €469.61 billion in 2025, with a long-term CAGR of 7.45% toward 2034, suggesting ample opportunities for space-related capabilities and collaboration.

Investor angle: The record ESA contracting and rising participation by Irish firms indicate a healthier pipeline of European space work, which could support valuations and attract investment in Irish space players. The government-backed focus, ongoing CM25 activities, and favorable market growth projections to 2034 highlight potential growth opportunities for suppliers and integrators, while external uncertainties and reliance on ESA awards remain considerations for risk assessment.

We’d love your feedback on SpaceTech Weekly - help us improve and get 15% off our services!

Disclaimer: This article is provided for informational purposes only and does not constitute investment advice. While we strive to ensure the accuracy and timeliness of the information presented, we cannot guarantee its completeness or correctness. Readers should conduct their own research and consult a qualified financial professional before making any investment decisions. Past performance is not indicative of future results.