SpaceTech Stock Performance: Public Equities and Top Subsector Winners

SpaceTech public equities performance: 1-, 3-, and 5-year returns by subsector, highlighting top winners, backbone infrastructure, and sector trends driving growth.

The information provided in this post is for informational purposes only and should not be considered financial advice. Readers should do their own research before making any investment decisions.

SpaceTech public equities have been volatile — a few companies skyrocketing, while most are still finding their footing. In this post, we break down how different space tech subsectors have performed over 1-, 3-, and 5-year periods, looking at both averages and medians to highlight standout winners versus broader trends.

We looked at 60+ publicly traded SpaceTech companies, grouped into six main subsectors — Aerospace & Defense, Earth Observation, Ground Equipment, Launch & Manufacturing, Satcom, Positioning/Navigation — plus an “Other” category. Using historical returns, we calculated equal-weighted averages and medians for each subsector, leaving all data intact without removing any outliers.

This shows the areas that drove broad growth, those lifted by a few “golden stocks,” how the sector’s landscape has shifted over time, and how space tech compares to major market benchmarks and leading ETFs.

Let’s start with the last year, which saw strong growth across all space tech subsectors, driven by increased government spending, expanding commercial use cases, and heightened investor interest in space infrastructure.

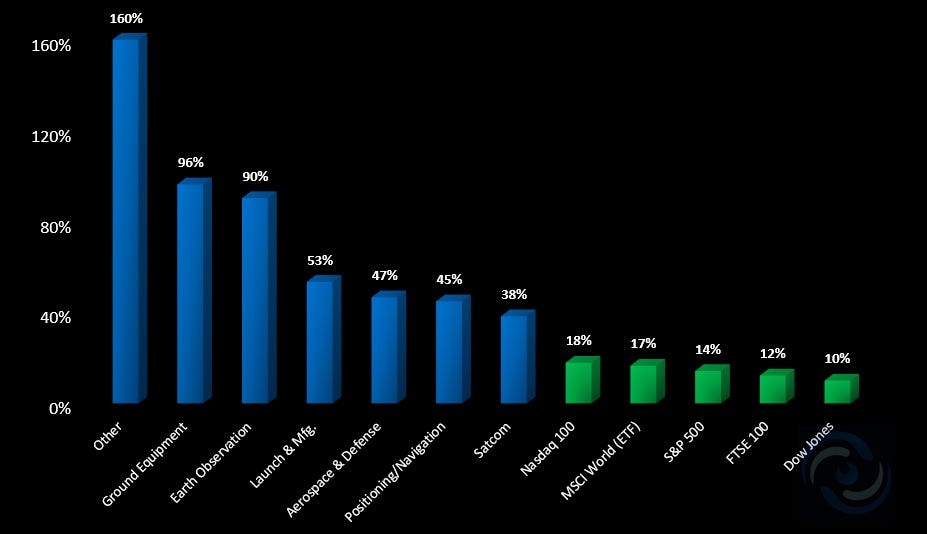

1-Year Surge: Space Tech Beats the Benchmarks

Over the past year, space tech stocks have left the big benchmarks far behind. While the S&P 500 and Nasdaq 100 grew by about 14–18%, most space sectors more than doubled, with areas like Earth Observation and Ground Equipment leading the way. Even the more traditional segments, like Launch and Satcom, grew much faster than the broader market.

The reasons are pretty clear: space is moving from being “future tech” to a real business. Governments and companies are investing heavily in satellites, data, and infrastructure. Geopolitics has pushed defense spending higher, while investors are excited about the potential of space data, navigation, and connectivity to power industries here on Earth. The sector also shows a higher beta than the overall market, reflecting not only its rapid growth potential but also greater downside risk during market declines.

Some standout winners may have skewed the averages, so to get a clearer picture, let’s examine the median values of subsectors.

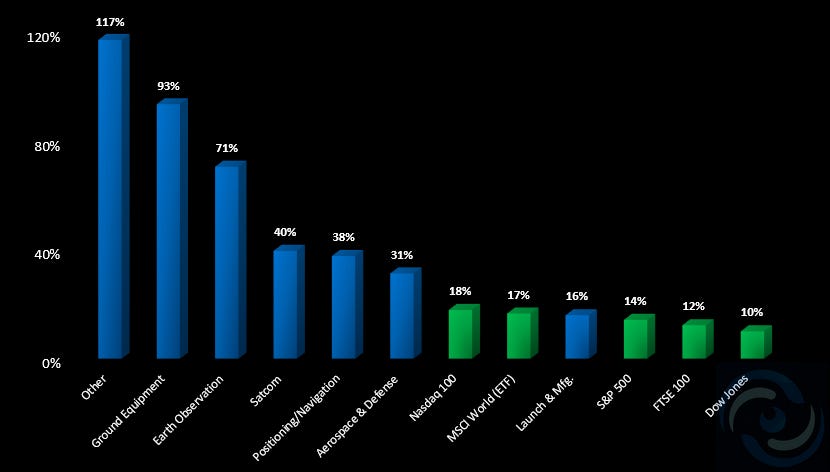

1-Year: Median instead of Average

Looking at both average and median 1-year returns helps show how growth was distributed across the sector. In areas like Launch & Manufacturing, Earth Observation, and Other, the averages are much higher than the medians, meaning a few standout companies drove most of the gains. Ground Equipment and Satcom, on the other hand, had averages and medians close together, showing more steady growth across the board.

Even using medians, most space tech subsectors still outperformed major benchmarks like the S&P 500 and Nasdaq 100.

The 1-year numbers tell us who made headlines, but which subsectors are actually building lasting momentum? Let’s take a look at the three-year picture next.

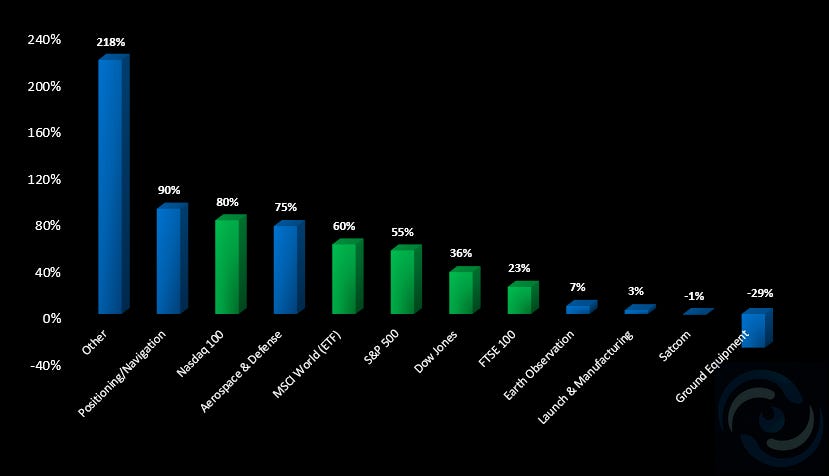

3-Year View: Backbone Builders Outpace the Market

The longer three-year picture tells a more refined story. Here, it’s the true backbone sectors — Aerospace & Defense and Launch & Manufacturing — that stand out for building the core infrastructure of the space economy. Alongside them, Positioning/Navigation has also been a consistent performer, not as a builder of rockets or satellites, but as a critical enabler layer powering precision agriculture, logistics, autonomous systems, and other downstream applications. These sectors have benefited from structural drivers that compounded over time:

Rising defense budgets fueling long-term contracts and steady revenue.

Navigation and geospatial demand accelerating with precision agriculture, logistics, and autonomous systems.

Reusable rockets and private launch infrastructure steadily lowering costs and opening new commercial opportunities.

This combination gave backbone players durable momentum, keeping them well ahead of major indices like the Nasdaq 100, S&P 500, and MSCI World.

By contrast, application-driven sectors such as Satcom and Earth Observation show a split between short-term hype and longer-term challenges. Satcom enjoyed strong runs in certain years, but market saturation and pricing pressure have capped sustained growth. Earth Observation has delivered technological progress but continues to face slow commercialization, long sales cycles, and dependence on government contracts. Ground Equipment sits in the middle — critical for enabling connectivity, but not as scalable or defensible as the core infrastructure layers.

The difference is clear: over one year, momentum and investor excitement can lift the entire space economy. But over three years, investors have consistently rewarded the companies building the infrastructure backbone — the rockets, satellites, and navigation systems that make everything else possible. Applications may still have their breakout moment, but so far, the backbone has proven to be the more reliable driver of returns in 3Y horizon.

Still, averages can be misleading — a few standout “golden stocks” can push the numbers up and hide how most companies are really performing. Let’s take a look at the medians to see the more typical results across each subsector.

3-Year Median: Seeing Beyond the Averages

Here, the story is more nuanced than the averages suggest.

Positioning/Navigation leads the way, with a median return of 90.3%, showing steady, broad-based gains across the sector. Aerospace & Defense also delivers solid performance (75.4%), reinforcing that backbone infrastructure remains the reliable engine of the space economy.

Launch & Manufacturing, though a backbone sector, has a median of just 3.3%, showing most companies lag behind a few standout winners. Satcom sits slightly negative at -0.5%, Ground Equipment at -28.8%, and Earth Observation at 6.9%, reflecting challenges like market saturation, scaling limits, and long sales cycles. While averages make these sectors look strong, medians reveal that broad, sustained growth remains limited.

In short, if averages show the space tech sector flying high, the median shows most companies still navigating turbulence — making some of the backbone sectors the safer bet for sustained growth.

That three-year view highlights where momentum has held up — and where it hasn’t. But stretching the horizon further could reveal even more.

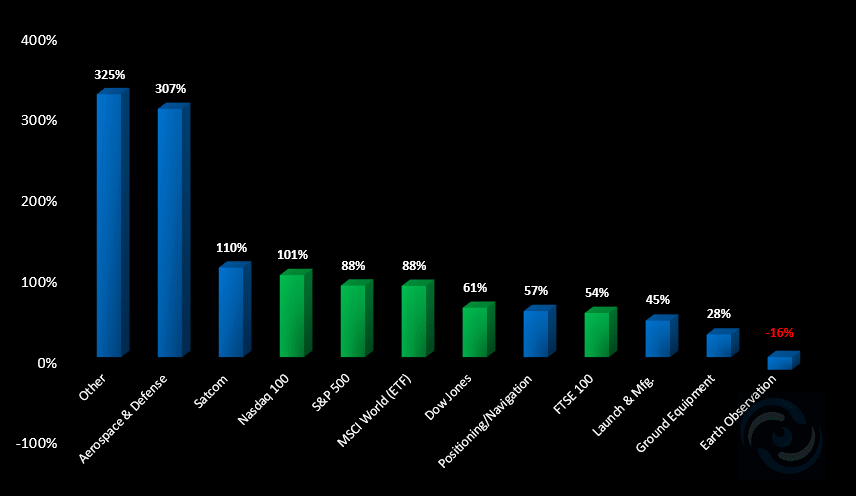

5-Year Performance: Long-term Picture

Looking at the past five years, space tech paints a very different picture compared to the short-term rally of the past year or the backbone-driven surge over three years. At the top of the long-term leaderboard are “Other” (+325%) and Aerospace & Defense (+307%), reflecting steady compound growth.

Defense primes and diversified space firms have benefited from multi-year government contracts, rising global defense budgets, and ongoing geopolitical tensions. Satcom (+110%) also performed well, boosted by earlier investment cycles in broadband constellations and connectivity projects, though more recent market saturation has slowed momentum.

Meanwhile, tech benchmarks like the Nasdaq 100 (+101%), S&P 500 (+88%), and MSCI World (+88%) performed strongly, but only a few space sectors, mainly Defense and Satcom, consistently stayed ahead over this longer horizon.

Some of the backbone sectors that are leading the three-year average performance story — Positioning/Navigation (+57%), Launch & Manufacturing (+45%), and Ground Equipment (+28%) — lagged over five years. Their explosive growth is more recent: reusable rockets, private launch cadence, and commercial navigation applications only began scaling in the past three to four years. Earlier in the period, launch was high-cost and irregular, and navigation lacked significant commercial traction, which is why the five-year returns still look modest compared to newer winners.

At the other end of the spectrum, Earth Observation (-16%) has struggled to translate technical advances into scalable commercial revenue. Long government-driven sales cycles, a still-developing private market, and investor skepticism have weighed on returns, keeping this segment behind the broader space tech rally.

Peeking at 5-year median returns shows how most space tech subsectors actually performed — beyond the few rockstars.

5-Year Median: Subsector Winners Over 5 Years

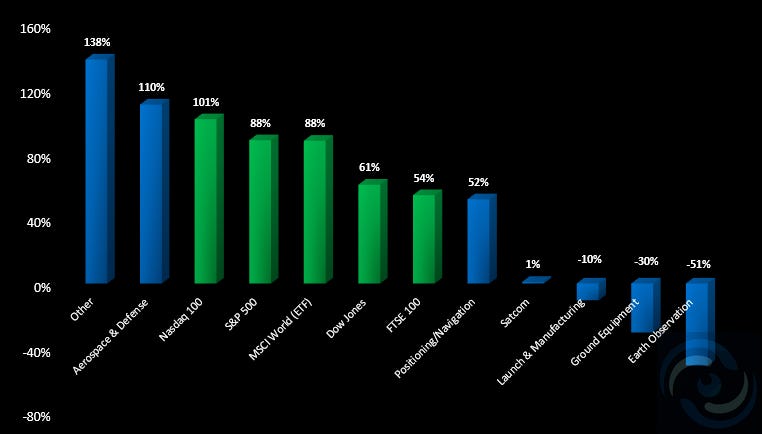

Other (+138%) and Aerospace & Defense (+110%) delivered broad-based growth, fueled by defense budgets, government contracts, geopolitical drivers, and commercial use cases on Earth like logistics, precision farming, and autonomous systems.

In Satcom, averages (+110%) mask the reality that most companies barely grew (median +1%), showing that early broadband constellation bets mainly benefited a few leaders. Launch & Manufacturing (-10% median) and Ground Equipment (-30% median) tell a similar story, with growth concentrated in a handful of winners while most firms struggle to scale. Positioning/Navigation is steadier, with median and average closely aligned, reflecting more uniform gains.

Earth Observation illustrates the sector-wide challenge: a -16% average becomes a brutal -51% median, highlighting long sales cycles, reliance on government contracts, slow private adoption, and competitive pressures impacting nearly every company.

Key takeaway

Space tech has been volatile but exciting, with some companies skyrocketing while most are still finding their footing. Looking at 1-, 3-, and 5-year averages shows the headline-grabbing winners, but median returns reveal a more nuanced story: in nearly every subsector, a handful of standout companies are pulling the averages up, masking how most firms are actually performing.

With only about 60 publicly traded companies in the dataset, the sample is limited, yet it still provides useful directional insight — highlighting that backbone and defense-driven sectors deliver more consistent, broad-based growth, while application-focused areas often rely on a few “golden stocks” to drive sector-level performance.

Next, we’re going deeper — exclusively spotlighting the top space tech winners over 1-, 3-, and 5-year periods, breaking down the stocks that are driving explosive growth.

Keep reading with a 7-day free trial

Subscribe to Cyclop SpaceTech to keep reading this post and get 7 days of free access to the full post archives.