AST SpaceMobile (ASTS) Analysis: Direct-to-Phone Satellite Broadband Revolution

AST SpaceMobile (ASTS) Stock, News, and Market Analysis: Technology, Partnerships, Financials, and Growth Outlook in Direct-to-Phone Satellite Broadband.

Welcome to the newest edition of our AST SpaceMobile coverage. As a major public player in SpaceTech, AST SpaceMobile’S updates provide valuable insights into key market dynamics and growth trends. Please note, this content is for informational purposes only and should not be considered investment advice.

In this issue, we break down their latest results, highlighting the main developments. For paid subscribers, we offer deeper analysis, exclusive insights, early access to reports, and expert commentary to help you make more informed decisions. Consider becoming a paid subscriber to unlock these benefits.

AST SpaceMobile (ASTS) is working on something genuinely ambitious: building the first satellite network that connects directly to everyday smartphones - no special devices, no extra hardware, and no complicated setup. The idea is simple but powerful: your regular phone should be able to connect from anywhere on Earth, even in places where traditional mobile towers simply don’t exist.

This direct-to-phone technology could completely change how mobile coverage works, especially for people in remote, rural, and underserved regions. Instead of relying only on ground-based infrastructure, satellites in space would help close the connectivity gap and bring reliable service to areas that have long been left behind.

AST SpaceMobile has quickly become one of the most closely watched companies in the satellite communications sector. Its regular updates and quarterly reports show steady progress toward building this global network. The company is partnering with mobile operators around the world, using licensed spectrum and a growing fleet of satellites to extend coverage beyond the limits of existing terrestrial networks.

Turning this vision into reality is anything but simple - it requires massive investment, complex satellite launches, regulatory approvals, and deep integration with telecom networks, all while facing increasing competition. Still, recent news and updates suggest meaningful progress, alongside the very real challenges that come with trying to reshape a global industry.

With this context in mind, the key question becomes: what does AST SpaceMobile do well, and where are the main risks? To answer that, let’s first break down the company’s core strengths and the biggest challenges it faces.

Pros

Innovative technology & unique offering:

ASTS aims to build the first satellite network capable of connecting standard mobile phones directly from space - no special terminals needed. This “direct-to-cell” approach is widely viewed as a game-changer, potentially unlocking mobile coverage in remote and underserved areas globally. Currently, most providers like Starlink require an additional device, but this solution would enable a much more cost-efficient, simple, and user-friendly experience.Valuable spectrum licenses:

The company holds important licensed spectrum assets (notably in the S-band) which some analysts believe alone are worth more than the company’s current market valuation. These licenses give ASTS a critical competitive edge.Strong partnerships and customer pipeline:

ASTS has signed agreements with major mobile network operators like Verizon, Vodafone, AT&T, and stc Group, as well as infrastructure partners and government entities including the U.S. Department of Defense. These partnerships validate the business model and provide potential revenue streams, but also important access to billions of users, which gives ASTS odds compared to Starlink’s lone trajectory.Advanced satellite technology:

Their next-generation satellites use large phased array antennas and proprietary ASICs to deliver high processing bandwidth and 5G+ speeds, which investors say surpass some competitors’ technology.Significant cash and funding raised:

Despite heavy cash burn, the company has successfully raised massive rounds and maintains a liquidity buffer to fund ongoing operations in the near term.First-mover advantage:

ASTS is ahead of competitors in launching direct-to-phone satellite services, with some investors confident this head start will translate into market leadership once satellites are operational.

Cons

Execution and delay risks:

The company has repeatedly delayed satellite launches, missing initial targets for 2025 deployments. The first block 2 satellite launches, originally planned for early 2025, has slipped to December 2025. Such delays hurt investor confidence and risk ceding ground to competitors.High cash burn and need for further dilution:

ASTS is a capital-intensive business, having burned more than $800 million in 9M 2025 alone. Despite recent fundraising, cash reserves are expected to last only a few quarters, indicating likely future dilution that could pressure shareholders.Increasing competition:

Although ASTS currently leads in technology for direct-to-phone connectivity, competitors like SpaceX (Starlink), Amazon Kuiper, and others are aggressively developing satellite broadband constellations. Starlink’s existing market presence and dominant launch capacity present a significant challenge. Once reusable Starship is developed, it will be able to bring massive satellites to orbit at only fuel cost.Regulatory and legal uncertainties:

There are potential risks around spectrum ownership - e.g., Ligado spectrum sits in a special purpose vehicle with outstanding litigation - which could complicate operations or delay service rollout.Unproven commercial viability:

Despite partnerships and tech demonstrations, ASTS has yet to generate meaningful revenue or prove widespread commercial adoption. Market acceptance of satellite cellular broadband remains uncertain.

So how is AST SpaceMobile different from other communication satellite companies?

AST SpaceMobile’s satellites are built to connect directly to unmodified 4G/5G cell phones - no special hardware (like a Starlink dish or a satellite phone) needed. Your existing smartphone could get signal even where terrestrial coverage is absent.

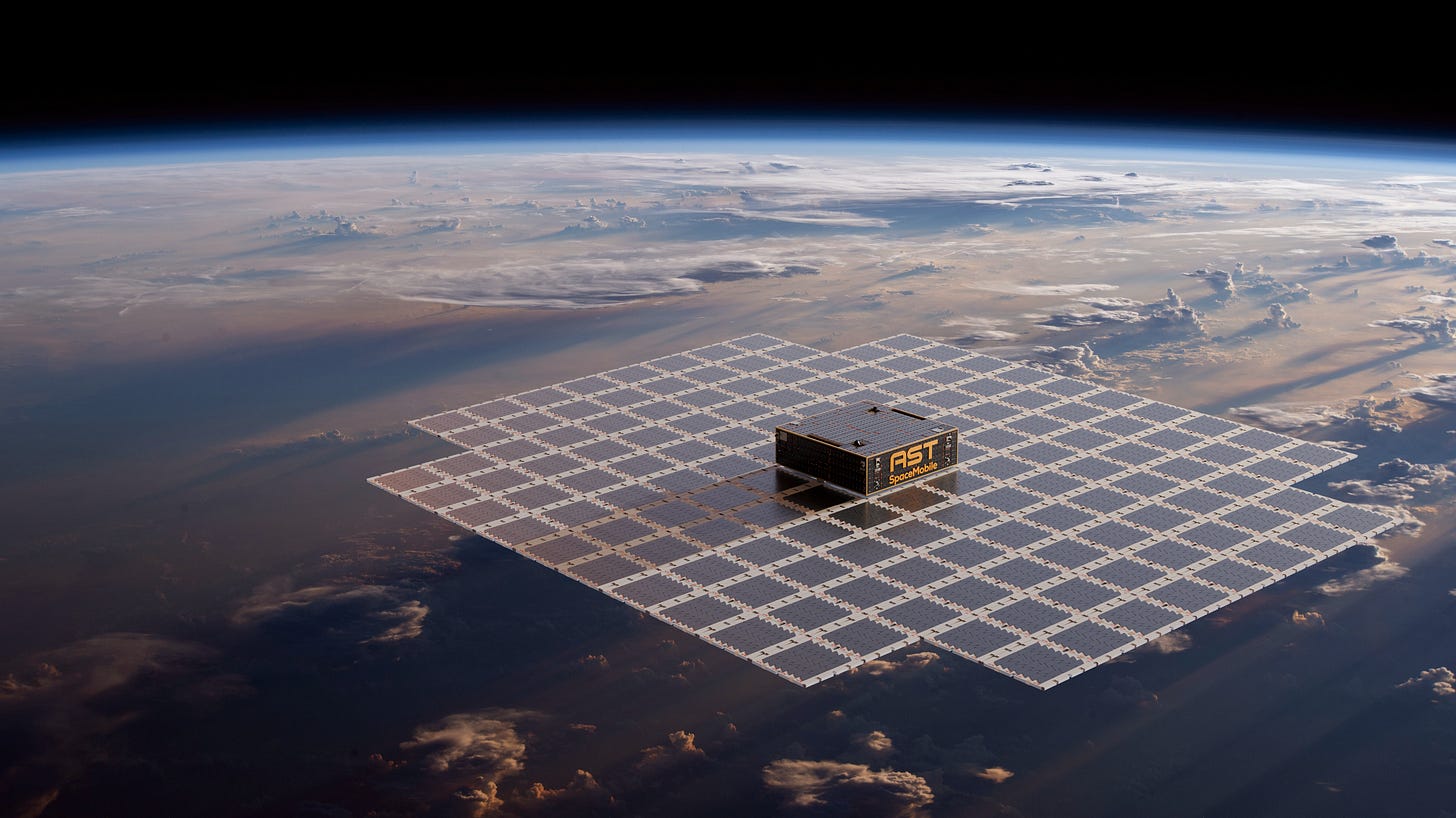

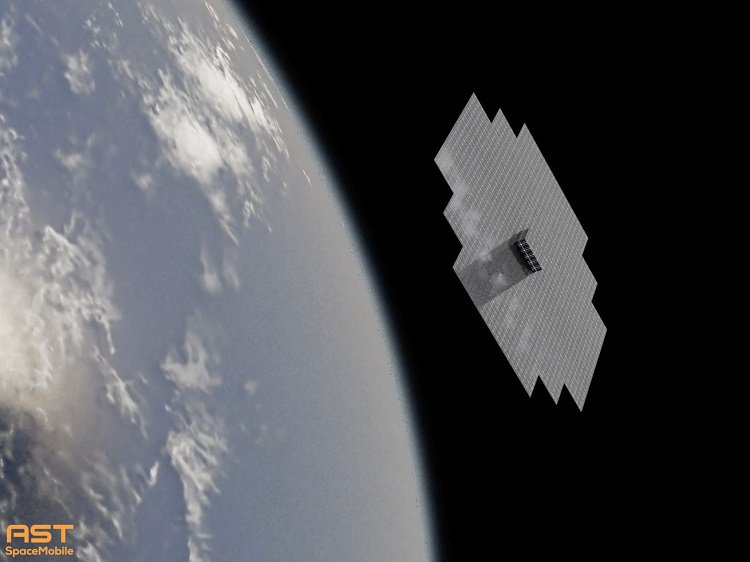

This is possible because their satellites, like the BlueBird series, feature massive, electronically steerable phased array antennas. They can connect millions of ordinary cell phones at broadband speeds using beamforming. Each satellite has large phased array antennas that create many narrow, precise beams - essentially tiny cell towers in space. These beams can be shaped, aimed, and intensified electronically, allowing the satellite to serve many users simultaneously while avoiding interference with terrestrial networks.

For example, a Bluebird passing over some rural town, it can provide coverage for just a few minutes before another satellite takes over. By adjusting the beam’s shape and angle, the system keeps a strong signal and aligns with terrestrial cellular network layouts and spectrum plans.

This approach, combined with ground stations and partnerships with providers like KSAT, American Tower, and Vodafone, allows AST to connect large numbers of ordinary smartphones at meaningful broadband data rates. In effect, AST is bringing broadband to rural and underserved areas, making space-based cellular coverage a reality at an unprecedented scale.

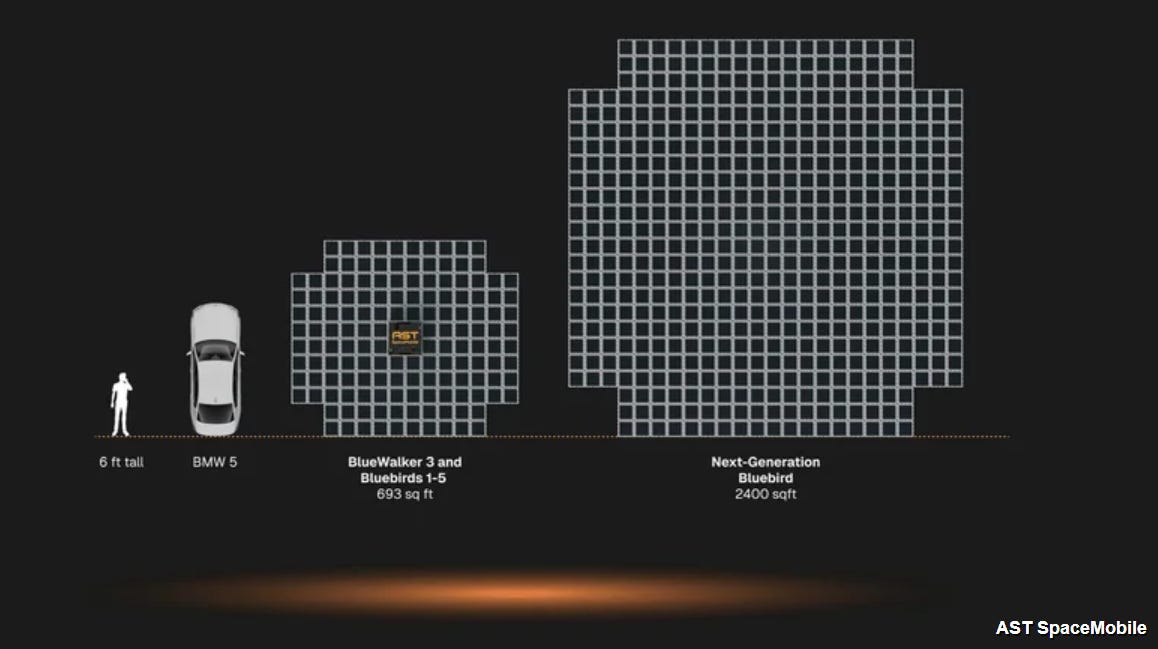

Products - size matters

At nearly 2,400 square feet, BlueBird 6 is over three times the size and 10x the capacity of AST SpaceMobile’s six satellites currently in orbit.

The satellite is designed to enable peak data rates of up to 120 Mbps directly to standard, unmodified mobile devices, supporting voice, full data, and video applications from space.

AST SpaceMobile announced that its BlueBird 7 satellite launch is scheduled for late February 2026 aboard Blue Origin’s New Glenn rocket from Cape Canaveral. BlueBird 7, featuring the largest commercial communications array in low Earth orbit, will improve the company’s space-based cellular broadband network, delivering up to 120 Mbps directly to standard smartphones worldwide. This mission marks the second in AST’s next-generation satellite campaign, part of a plan to launch 45–60 satellites in 2026, accelerating global 4G and 5G connectivity from space without requiring any device modifications.

The satellites were built with 95% vertical integration across AST SpaceMobile’s assembly, integration, and testing facilities in Midland, Texas, giving some cushion to investors when it comes to control of manufacturing.

Next, we will dive deeper much deeper into market, trends, contracts, financials from the latest quarterly report and rivals.